RPO & the India Advantage

Contributors:

Josh Bersin

Founder, The Josh Bersin Company

Roop Kaistha

Regional Managing Director, APAC, AMS

Rebecca Wettemann

CEO, Valoir

Long known as the destination for call centers and back-office processing, the outsourcing and offshoring giant is pivoting to R&D, engineering, data analytics and now AI.

Here’s why your organization must join Team India.

When it comes to outsourcing, India remains the gold standard.

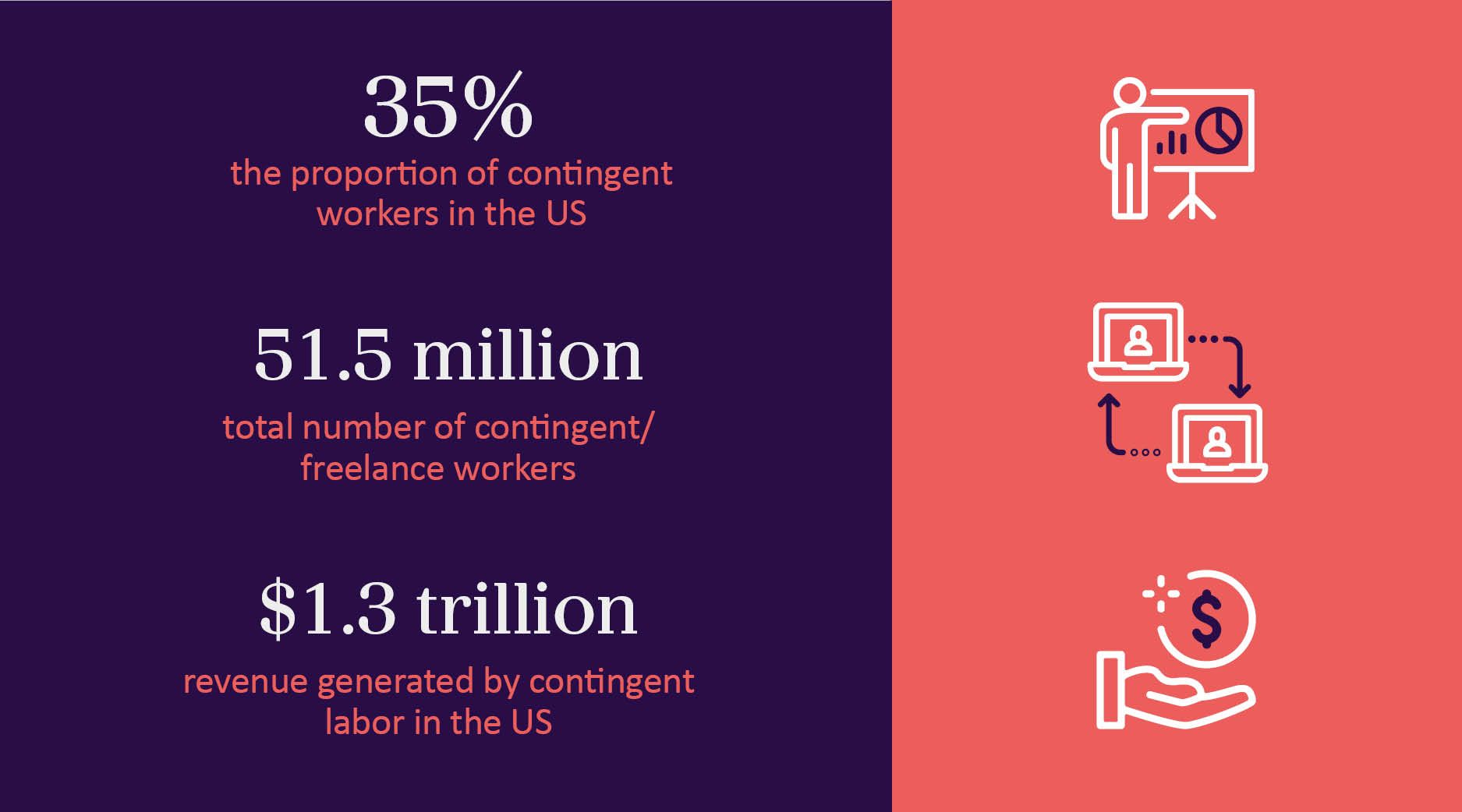

Starting around 2000, India’s outsourcing firms have blossomed from a collection of industrious, savvy, and reliable business processing services that oversaw western companies’ call centers and back office operations to become the go-to destination for offshoring, nearshoring and captive sites for major global businesses. And despite the global and regional booms and busts of those past two decades, India remains the top partner for companies seeking to streamline operations, centralize business tasks, and achieve greater savings.

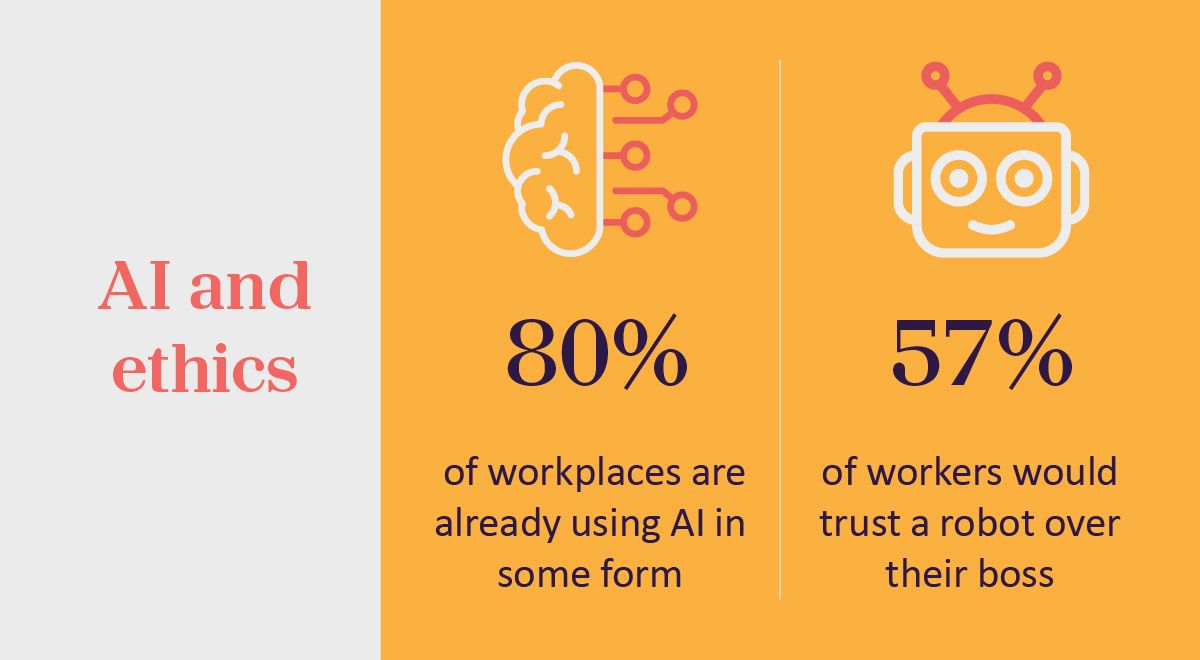

In the years since the global pandemic and the subsequent lockdown, India pivoted to become a center of true technological innovation that is dedicated to the next-wave advancements in programming, research and development, engineering, data analysis and the newly introduced business tools: artificial intelligence and Generative AI. India outsourcing centers also embrace hybrid and office-based working models which help broaden the search for candidates who are entertaining multiple job offers in a tight labor market.

Let’s look at the India RPO advantage by the numbers:

– India’s total labor force is an estimated 437.2 million, i.e., larger than the total population of the United States (338.3 million)

– India’s Global Capability Centers employ up to 70% of the world’s GCC headcount

– Last year, India reported an overall leasing volume of 27.3 million sqft in the offshoring industry, a 26% increase from the previous year

– Demand for AI services could reach $17 billion by 2027, according to a report by IT industry body Nasscom

– Last year, around 45% of high-tech and travel companies, and 43% of telecom, manufacturing, and construction firms, nearshored operations to India, per media reports

In a few short years, India is now not only an exporter of high talent, it’s attracting and retaining talent as well. As forward-thinking talent acquisition leaders looking to expand its recruitment process outsourcing, it’s time to prepare for the next India business revolution.

Why does India continue to remain an attractive offshoring partner especially when it comes to RPO? According to Roop Kaistha, regional managing director of APAC for AMS, it all boils down to India’s advantages as an outsourcing partner. The nation is politically stable (Prime Minister Modi was re-elected in June 2024); its young and well-educated workforce, and investments into infrastructure. The world’s largest democracy also created the 18th largest exclusive economic zones inside the country, and around Asia, Europe, Africa and North and South America.

“It’s not that people are flocking to India without the country doing anything. We all know that India was the back-office call-center hub twenty years ago, but the government and Indian businesses have moved outsourcing up the value chain to offer more services,” says Kaistha. “India is now a net giver of talent,” she says.

Talent acquisition industry experts have witnessed the same transformation.

“While many call centers and back office operations were staffed in India for cost reduction, companies now use Indian talent for engineering, research, sales, and other design and innovation needs. Professionals in India are well educated and ambitious to succeed, making such teams highly competitive and often much less expensive to hire,” says Josh Bersin, founder of the HR technology consultancy The Josh Bersin Company.

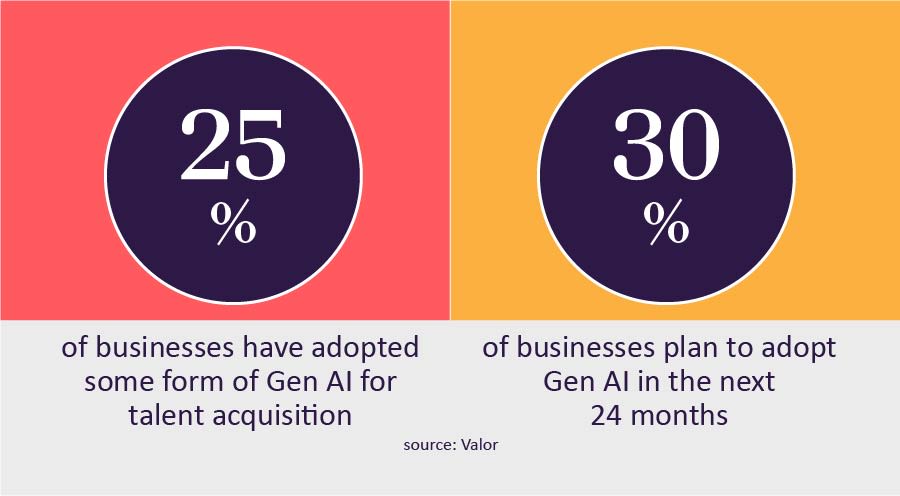

Rebecca Wettemann, CEO of the HR technology market research firm Valoir, says she and her colleagues are seeing organizations look to hire Indian resources to support research and development, data science, and AI, as well as support for cloud applications.

“The growing availability of qualified resources in India is certainly part of this but so is the growth of indigenous Indian technology companies such as Zoho raising awareness of India’s ability to deliver innovation in the tech sector,” says Wettemann.

The India Partnership

This is not news to AMS customers.

According to Kaistha, roughly 70% of AMS RPO clients have either established GCCs in India or they are in the process of performing due diligence or establishing these centers right now. India recently began offering what Kaistha calls “end-to-end integrated service centers” that handle business tasks ranging from operations to HR.

“Companies in the U.S. and Europe are establishing innovation centers, including sandbox and digital innovation facilities, for this growing market,” she says. She adds that many, well known, financial giants credit India’s centers of excellence (COEs) as a critical part of their tech transformation.

AMS also helped a global pharma giant that operated its tech development center in India. This project requires incorporating IT recruiters and sourcers into the AMS team, while advising on skills availability and salary market insights. AMS also targeted specific talent pools for aspirational candidates to meet salary bandings. Together with AMS guidance, the client hired more than 260 IT and data analytics employees with a 45-day time to offer.

A major European bank that operates a multi-location GCC in India needed sourcing and admin for 6,000 hires across India, including 2,700 technology roles. In 10 weeks, AMS deployed a team of 100 TA experts in less than three months, managing 1,500 requisitions within weeks, optimizing processes and cleansing data to remove backlogs, while reducing agency reliance and improving compliance. This RPO initiative delivered 225 technology hires per month, 44 days time-to-offer, 50 hires per month in all roles, and an 82% offer-to-start ratio.

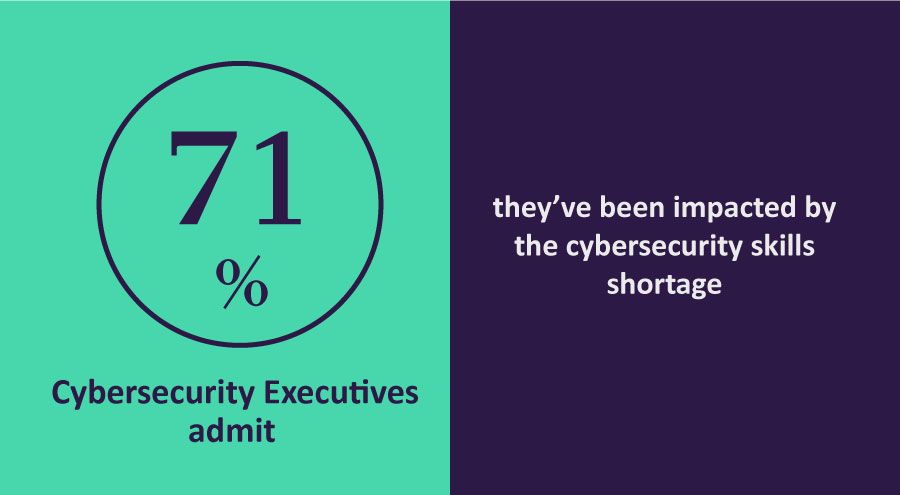

Skills, Education and Infrastructure: The Right Stuff

When finding talent in India, it comes down to attracting, interviewing and nurturing the right candidate with the right skills. Thanks to India’s young population and their knowledge of English, Mandarin, French and German among other languages, Indian firms have near bottomless offering of highly skilled labor. But there are challenges when it comes to outsourcing to India — as well as other nations.

“The main issues to consider are leadership and alignment with other international teams, as well as the broad time zone differences to manage. Many of the high-performing Indian teams I meet work nights or other hours to align well with their US or European teammates,” adds Bersin. “It’s also important for teams around the world to get to know each other and meet face to face regularly.”

TA leaders looking to hire in India must determine and pinpoint the skills the open positions require currently and in the future. And any organizations looking to hire must budget for a realistic time frame. This is not a rush job, says Kaistha. “Sometimes clients expect that they can simply lift and shift people from one project or division to another,” she says.

Plus, the time-to-productivity must be monitored and addressed. “We find that if clients don’t have the right outsourcing and RPO partner, uncertainty can begin to take root,” says Kaistha. She adds that HR and TA leaders are usually informed by the business divisions about the open roles and the selected skills and then told to “go find them.”

“At AMS we know how talent acquisition processes work,” says Kaistha. “TA searches need to be calibrated so we find sometimes that [filling these roles] is a big challenge.”

And outsourcing is not just for Fortune 500 companies. AMS recently partnered with a modestly-sized Japanese pharmaceutical client that operated in a niche segment. Although it is not a household company name, they were looking to hire around 400 new workers per annum in India. The clock was ticking. Like similarly-sized clients, the pharmaceutical company considered relying on agencies that typically charge less than RPO firms. AMS was able to hire new staff without relying on agencies in what Kaistha called a “commoditized market.”

“Sometimes clients say ‘we’re just going to use agencies because it’s so cheap,’ and they can very easily get into that trap if they cannot find the right TA partner,” she says.

The Future of Outsourcing: India

Even with these challenges, India will remain the top outsourcing provider in the decade to come. Kaistha believes that the technology layoffs that occurred in the U.S. and Europe in late 2022 are not in the India outsourcing forecast.

“My crystal ball is looking very optimistically into the future, and it says that we are going to go back to pandemic hiring numbers. There will be ups and downs in economies and a bit of decoupling has happened globally, like in China, but it can’t be sustained for too long,” she says.

“I truly think that hiring numbers will come back up in the second half of 2024 but going into 2025, we will see pre-COVID hiring numbers thanks to the huge focus on employee skills,” she says. “Unemployment rates are still relatively low and spending is kind of back because interest rates are likely to go down. So just based on those factors, I do think hiring numbers will come back.”

To find the workers in India with the right, cutting-edge skills,

AMS experts will be able to help.

Written by Phil Albinus and reviewed by the Catalyst Editorial Board

with contributions from:

The Future of Outsourcing: India

Even with these challenges, India will remain the top outsourcing provider in the decade to come. Kaistha believes that the technology layoffs that occurred in the U.S. and Europe in late 2022 are not in the India outsourcing forecast.

“My crystal ball is looking very optimistically into the future, and it says that we are going to go back to pandemic hiring numbers. There will be ups and downs in economies and a bit of decoupling has happened globally, like in China, but it can’t be sustained for too long,” she says.

“I truly think that hiring numbers will come back up in the second half of 2024 but going into 2025, we will see pre-COVID hiring numbers thanks to the huge focus on employee skills,” she says. “Unemployment rates are still relatively low and spending is kind of back because interest rates are likely to go down. So just based on those factors, I do think hiring numbers will come back.”

To find the workers in India with the right, cutting-edge skills,

AMS experts will be able to help.

Written by Phil Albinus and reviewed by the Catalyst Editorial Board

with contributions from:

Josh Bersin

Founder, The Josh Bersin Company

Roop Kaistha

Regional Managing Director, APAC, AMS

Rebecca Wettemann

Rebecca Wettemann, CEO, Valoir