Why pharma and life sciences industry needs to rethink talent attraction

Contributors:

Georgia Pink

Analyst and Head of Event Content, LEAP TA: Life Sciences

Chip Holmes

Managing Director, Client Services, AMS

The life sciences and pharmaceutical industry is facing massive disruption. Biotechnology, digitization and ‘a patent cliff of tectonic magnitude’ are transforming the industry, changing how treatments are developed and delivered while also leading to a revolution in the roles and skills needed.

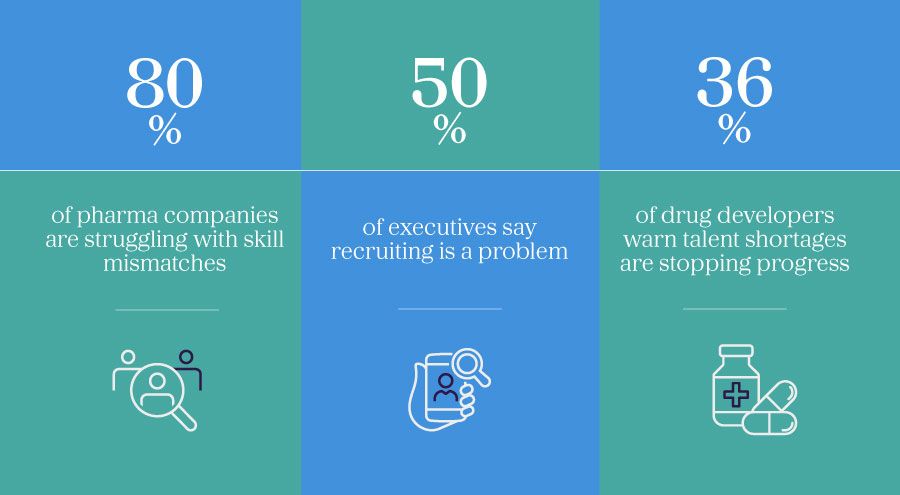

With such change, industry skills gaps are increasing. Four out of five (80%) of pharmaceutical manufacturing facilities are struggling with skills mismatches and half of all executives say that recruiting experienced staff is challenging, according to the report. Things aren’t much better in the clinical trial sphere, with more than a third (36%) of drug developers warning that talent shortages are limiting progress.

To solve these shortages, life sciences companies are having to think more creatively about how they recruit, attract, retain and upskill both existing and new talent.

“Life sciences has some significant challenges at the moment. As Deloitte says, we’re going from doing digital to being digital. We have all these roles to fill that two years ago didn’t exist. We also know that in five years time, there will be more jobs to fill that we currently have no idea about. So where do we find the people needed to fill these roles?’ asks Chip Holmes, managing director, client services at AMS.

Growing talent pools

For Holmes, the move towards digitization starts with re-evaluating how life sciences and pharmaceutical companies recruit. With such a limited talent pool to choose from and new skill-sets required, it no longer makes sense to focus on past experience or job history.

“Currently, life sciences companies are hiring too much against job descriptions, with hiring managers looking for people already within the industry who can do a particular job. Skill-based hiring is about hiring for aptitude and propensity to learn. You hire them, and train them in what they need,” says Holmes.

When shining a light on attracting talent, internal hiring is of critical importance especially within the life science sector. A lack of focus on internal mobility risks growth, according to new data analysis by AMS and The Josh Bersin Company. AMS’s latest Talent Climate Series on Internal Hiring is a challenging read for many talent acquisition teams who have spent so long bringing great talent into organizations only to see it walk out of the door to find new opportunities. The data, compiled in association with experts at The Josh Bersin Company, highlights that only 25% of roles today are filled by internal hiring, but with effective skills mapping, great technology, and building a culture of mobility, organizations can turn that tide and accelerate growth.

Georgia Pink is an analyst and senior event producer at Hanson Wade, which curates the LEAP HR’s Life Sciences global conferences. She agrees that skills-based hiring is high on the agenda in the sector.

“We frequently hear that life sciences organizations need to be able to identify and navigate future talent needs to fill the growing skills gaps and the increasing number of open positions. As a result, we’ve seen a greater focus in 2023 on skills-based hiring, which for many companies is replacing the traditional approach and opening up opportunities to reach a far wider talent pool,” says Pink.

“Not only is this enabling life science organizations to fill positions more quickly, but it is allowing them to match candidates to roles in a more meaningful way, whilst challenging biases that come with a more traditional approach to sourcing talent,” she adds.

Strategies for growth

Moving towards skills-based hiring also allows life sciences and pharmaceutical companies to improve on another strategic business aim - diversity.

According to Biospace’s 2022 Diversity in Life Sciences report, 65% of the life sciences workforce is white, with black people making up 6% and Hispanic/Latinx individuals 8%. By focusing recruitment on potential and skills rather than experience and education, hiring managers can open up new talent pools.

Recruiting for potential leads to another change talent leaders need to make - and that’s to focus more on internal career development and skills building.

“This is the first time individuals in life sciences have had - en masse - a willingness to move industries. It used to be that when you were in life sciences, you were in and spent your whole career here. Now, we’re at a point where people think there might be opportunities in other industries,” warns Holmes.

Combating this potential talent drain means creating the right opportunities for individuals to develop and progress. From a diversity perspective, that means ensuring that talent from different backgrounds not only have the opportunity to progress, but also see and hear from role models in senior positions.

It also means rethinking your employer brand to ensure that you target the right people on the right channels. Research is key, as the image a company thinks it projects is often at odds with the one candidates see.

“Employer branding is key. How do we move from having an employee value proposition to a talent value proposition? The start is to consider the segments of talent you are targeting. We’ve worked with life sciences companies who say they want to be more diverse, but when we run a persona check on the people they’re reaching out to, they all look the same”, says Holmes.

“It’s vital to do your research. Does what you put out to market match what people are saying about you? Oftentimes, companies find that they are not who they think they are,” he adds.

Pink agrees that brand activation and defining an effective EVP is increasingly important to companies in the sector.

“Companies doing noticeable work in this space are actively leveraging internal and external data insights to understand the reality of the brand they are portraying. Analyzing this data and understanding how your organization is perceived is key to identifying and defining a truthful and impactful EVP,” she says.

Future optimism

Despite a downturn in recruitment and the ongoing talent shortage, Holmes believes there is plenty for the sector to be positive about. He sees 2023’s levelling out of recruitment as a temporary measure, predicting that by 2025 we’ll begin to see an upward curve in hiring again.

However, the make-up of where the industry gets its talent from, and where it’s based is likely to change. Holmes cites the APAC region as an area of growth with tremendous talent pools and a bigger consumer base, with EMEA and the US markets more saturated.

“One of the things life sciences really needs to look at is a global location strategy. I’m aware of a couple of life sciences companies who are really trying to change their employee percentages in India and China by looking to move into those areas. They’re not going to exit the US, but they’re looking for a diversified strategy,” he says.

This reimagining of what the life sciences and pharmaceuticals sector looks like is going to continue. Thriving through this period of uncertainty requires agility, flexibility and an openness to change.

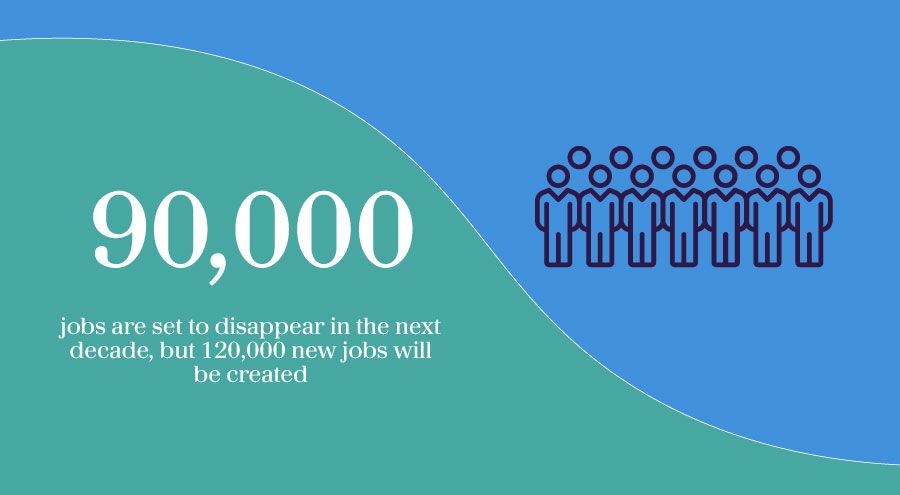

“Companies need to be thinking about how artificial intelligence is going to affect the industry and how they can become more digital. The future of life sciences is very bright, but talent is hard to find. Jobs are going to exist and grow, but the skill sets, and profile of people is going to change. We need to be ready for that,” says Holmes.

written by the Catalyst Editorial Board

with contribution from:

Georgia Pink

Analyst and Head of Event Content, LEAP TA: Life Sciences

Chip Holmes

Managing Director, Client Services, AMS